A beginner’s budgeting guide to buying their first property - 2024

Buying a property in Singapore may seem like a daunting ordeal, with plenty of property and mortgage jargon, along with ever changing regulations. The first aspect should always be proper budgeting, as knowing your figures well will help you to better understand your available options in the market.

The aim of this guide is to help shed some light and insights that you may find helpful.

Table of Contents:

Simply click on any of the links below to find out more on your interested topic.

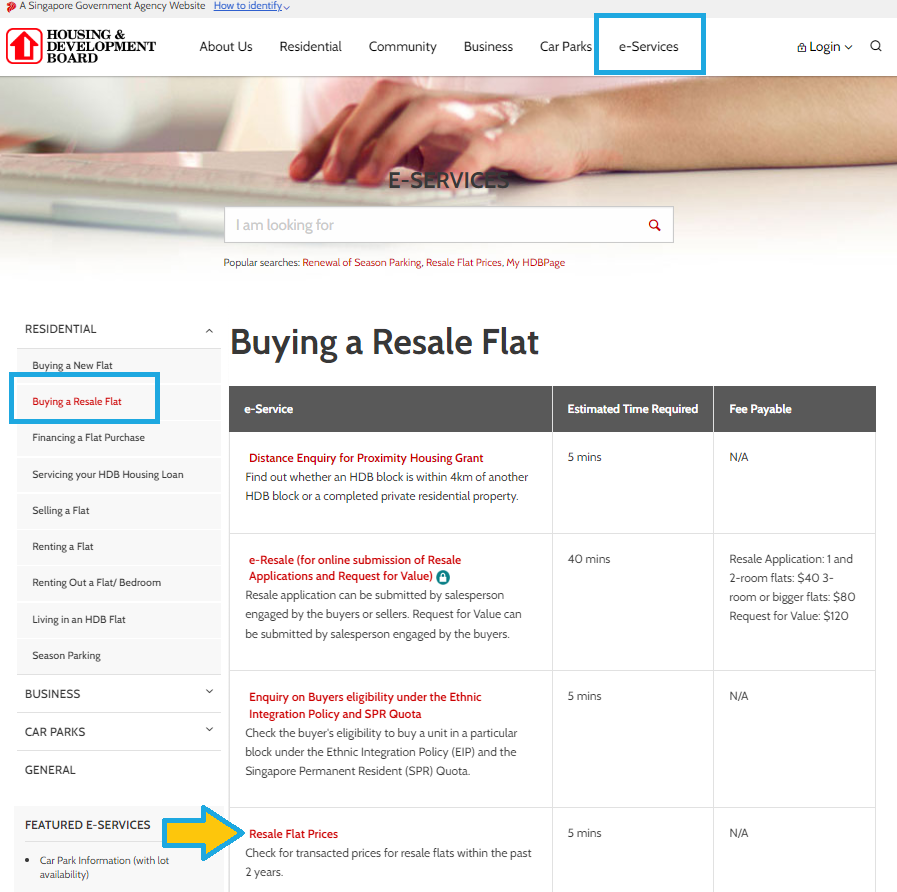

Checking Valuations

When you are looking through property listings, a common thought would be whether the property is being listed at a reasonable price. This is indeed important, because if you were to buy a property that is overpriced (a price that neither HDB nor the banks feel is a fair market valuation), you will end up needing to pay Cash Over Valuation (COV).

This is an important budgeting consideration as there are cases where clients need to forfeit the entire purchase (along with their deposits) because they could not afford the additional cash outlay required due to COV.

For HDB properties – the valuation is determined by HDB directly, you can only request for a valuation report from HDB after the Option To Purchase (OTP) has been granted. One way to make a calculated guess on whether the listing price is reasonable would be to check recent resale HDB transactions here.

For Private properties – the valuation is determined by the banks, and different banks may have different valuations on the property. You need not submit an OTP to the bank for a valuation check. At TLC, we are able to help our clients with valuation checks with various banks before they commit to a purchase.

Case Study:

Client placed a $1,000 Option Fee for a HDB priced at $500,000, and he intends to take a bank loan to fund this purchase.

HDB came back with a valuation of $480,000, hence there is a COV of $20,000 payable.

Therefore, the total minimum cash outlay required will be $20,000 COV + (5% x $480,000 = $24,000) = $44,000

If the client is unable to pay this $44,000, he will need to forfeit the $1,000 Option Fee.

This highlights the importance of setting aside additional cash funds to prepare for the event that COV is payable.

Understanding the down payment requirements

How much cash on hand and CPF you have in your Ordinary Account (OA) plays a large part in determining your true budget.

As banks will not be able to finance 100% of your purchase, this section will help you understand the financial structuring available for your first property purchase.

For your first property purchase using a HDB loan:

- Cash Over Valuation (if any)

- $5,000 Option Fee by Cash

- Loan tenure does not exceed 25 years or age 65

- Loan cannot exceed 80% (LTV / Loan-To-Valuation) of purchase price or valuation, whichever is lower.

- Balance can be funded by Cash or CPF

For your first property purchase using a bank loan, there are generally two options available:

Option 1:

- HDB: Loan tenure does not exceed 25 years or age 65

- Private Property: Loan tenure does not exceed 30 years or age 65

- Cash Over Valuation (if any)

- Minimum 5% Cash Down Payment

- Loan cannot exceed 75% (LTV / Loan-To-Valuation) of purchase price or valuation, whichever is lower.

- Balance can be funded by cash or CPF

Option 2:

- HDB: Loan tenure does not exceed 30 years or age 75

- Private Property: Loan tenure does not exceed 35 years or age 75

- Cash Over Valuation (if any)

- Minimum 10% Cash Down Payment

- Loan cannot exceed 55% (LTV / Loan-To-Valuation) of purchase price or valuation, whichever is lower.

- Balance can be funded by cash or CPF

Which option is more suitable for you, largely depends on how much loan you require. If you require more than 55% LTV, then you can only go for Option 1, if you require less than 55% LTV, then both Option 1 and Option 2 are available.

Consider this scenario:

- Profile of Client: 54 years old / Singaporean

- Purchase Price: $1,000,000 (Bank’s Valuation matched, no Cash Over Valuation / COV)

- Type of Property: Resale Private Condo

- Available Cash on hand: $150,000

- Available CPF in OA: $500,000

- Required Loan Amount: $400,000 as he needs to save some cash for renovation

IPA granted by the bank:

Option 1:

$338,000 over 11 years tenure, capped at 75% purchase price or valuation, whichever is lower. Min 5% Cash Down Payment.

Option 2:

$577,000 over 21 years tenure, capped at 55% purchase price or valuation, whichever is lower. Min 10% Cash Down Payment.

In this scenario, if the client opts for Option 1, he will be unable to complete the purchase as his income is not strong enough for the bank to grant him a $400,000 loan based on 11 years loan tenure.

- Purchase Price: $1,000,000

- Buyer Stamp Duty: $24,600 (by cash first)

- Legal Fee: $2500 by cash or cpf

- Valuation Fee: $400 by cash

Total funds required: $1,027,500

- Max loan granted from bank: $338,000 over 11 years

- CPF OA: $500,000

- Cash on hand: $150,000

Total funds on hand: $988,000 (unable to complete)

However if the client opts for Option 2, the bank will be able loan him up to $577,000. Therefore it is sufficient for his minimum required loan amount of $400,000 (40% LTV), and he has an alternative to increase the loan amount to $550,000 (55% LTV) if he wants to free up some extra cash for renovation etc (home mortgage interest rates are usually considered cheap liquidity).

- Purchase Price: $1,000,000

- Buyer Stamp Duty: $24,600 (by cash first)

- Legal Fee: $2500 by cash or cpf

- Valuation Fee: $400 by cash

Total funds required: $1,027,500

Breakdown:

- Max 55% Loan taken from bank: $550,000 over 21 years

- 10% Cash Down Payment: $100,000

- Balance 35% by CPF: $350,000

- Buyer Stamp Duty: $24,600 (by cash first)

- Legal Fee: $2500 by cash or cpf

- Valuation Fee: $400 by cash

Client will have spare cash of approximately $50,000 (assuming he claims a refund from CPF for his stamp duty)

—–

Side note, for resale HDB purchases:

Legal Fee: $1,800 estimate by cash or CPF payable to law firm

Valuation Fee: $120 by cash payable to HDB

Getting an In-Principle-Approval (IPA)

Most individuals would require getting a mortgage loan from a bank to facilitate the purchase of their properties. Knowing how much loan the banks are willing to grant is extremely important, as you will not want to be caught in a situation where the deposit has been placed and no banks are willing to lend you the required amount to complete the purchase transaction.

You may have done some research and calculations by yourself, or someone in a professional capacity (mortgage broker, mortgage banker, property agent) has given you some indicative figures based on the financial information provided from you. This is not sufficient in my opinion, as ultimately there is no formal approval given in writing.

In order to eliminate any doubts, the safest method is to definitely have a formal IPA done by at least one bank before you commit to a purchase. A formal IPA can only be granted by the bank after you have submitted a full application with the required documents to the banker. A detailed guide on how to retrieve some common documents required can be found here.

One common misconception is that the current mortgage plans being offered from the banks can be secured by getting an IPA, do take note this is untrue. The earliest you can actually secure a mortgage plan from a bank is when you are able to provide the purchase OTP (for HDB, you will need to provide the HDB valuation report as well).

The interest rates that the banks use to help calculate your loan eligibility is actually the stress test percentage. Think of the stress test percentage as one of the tools the banks use to calculate your loan eligibility. In layman terms, the higher the stress test, the lower the loan amount. Different banks have different stress test percentages, which is partly the reason why you may get different IPA amounts from various banks. As of march 2024, the stress tests of the banks are generally in the 4% range. Other factors that affect the IPA amount will be your income, credit facilities, credit score/history, and loan tenure (longer tenure will result in higher loan amount).

Take note that getting a formal IPA is free of charge, has no-obligations, and most are usually valid for one month. Hence there is no reason not to get it done for a peace of mind.

At TLC, we offer assistance with initial indicative calculations and connect you with our senior mortgage bankers from various banks for a formal In-Principle Approval (IPA). The turnaround time for the IPA approval is typically faster through our services, as we help streamline the process and our bankers give priority to cases referred by us.

Knowing your monthly commitments

Singapore is one the most expensive cities to live in, exercising prudence when it comes to your monthly expenses is part of the solution to financial well-being. A property purchase will likely be a huge financial commitment, hence do consider the following recurring costs:

- Mortgage Monthly Instalments

- Service & Conservancy Charges / Maintenance Fees

- Utilities

- Property Tax

- Mortgage Insurance

- Fire Insurance

What affects mortgage monthly instalments are three factors:

- The loan amount

- The interest rate

- The loan tenure – a longer tenure will result in a lower monthly instalment, but higher interest payable, while a shorter tenure will result in a higher monthly instalment, but lower interest payable.

Example:

Loan Amount – $1,000,000

Interest Rate – 2 Year Fixed at 2.90%

- Tenure: 30 Years

- Monthly Instalment: $4,162.30

- Interest paid over 2 years: $56,814.76

- Tenure: 20 Years:

- Monthly Instalment: $5,496.05

- Interest paid over 2 years: $55,909.18

Hence, even though the loan amount and interest rates are the same, a shorter tenure of 20 years will increase the monthly instalment by $1,333.75 and decrease the total interest paid to the bank over 2 years by $905.58.

There is no right or wrong when it comes to the duration of the loan tenure, it ultimately comes down to your monthly budget and financial perspective.

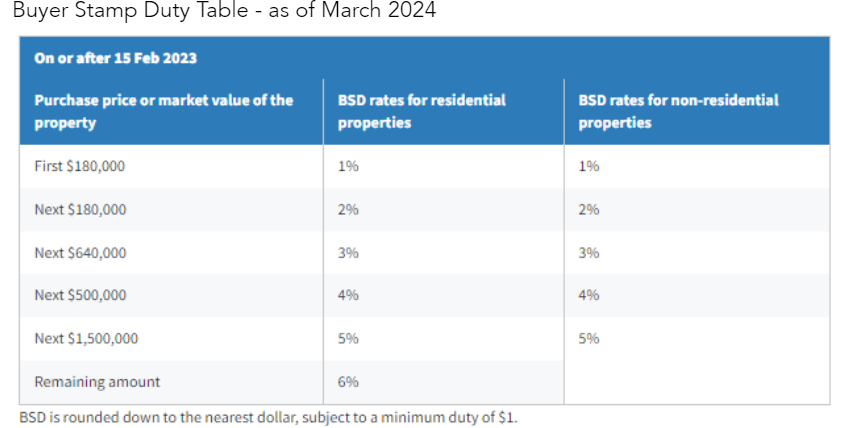

Explaining Buyer Stamp Duty (BSD) & Additional Buyer Stamp Duty (ABSD)

Tax is payable to IRAS whenever an individual purchases a residential property in Singapore. The tax terms commonly used are Buyer Stamp Duty (BSD) & Additional Buyer Stamp Duty (ABSD).

BSD & ABSD can be paid using cash or cpf. However do take note that for the purchase of completed private properties, law firms will usually request for a Cashier’s Order from you upon the exercising of the option. The rationale is that these taxes will need to be paid to IRAS within 14 days from the date of exercise, CPF will very likely not be able to disburse the funds to IRAS in time. Hence the requirement for these taxes to be paid in cash first, let the law firm know if you require a refund from CPF upon the completion of your purchase.

All individuals will need to pay BSD to IRAS when they purchase a residential property in Singapore.

Example:

Purchase Price: $1,000,000

- First $180,000 @ 1% – $1,800

- Next $180,000 @ 2% – $3,600

- Next $640,000 @ 3% – $19,200

Total BSD payable: $1,800 + $3,600 + $19,200 = $24,600

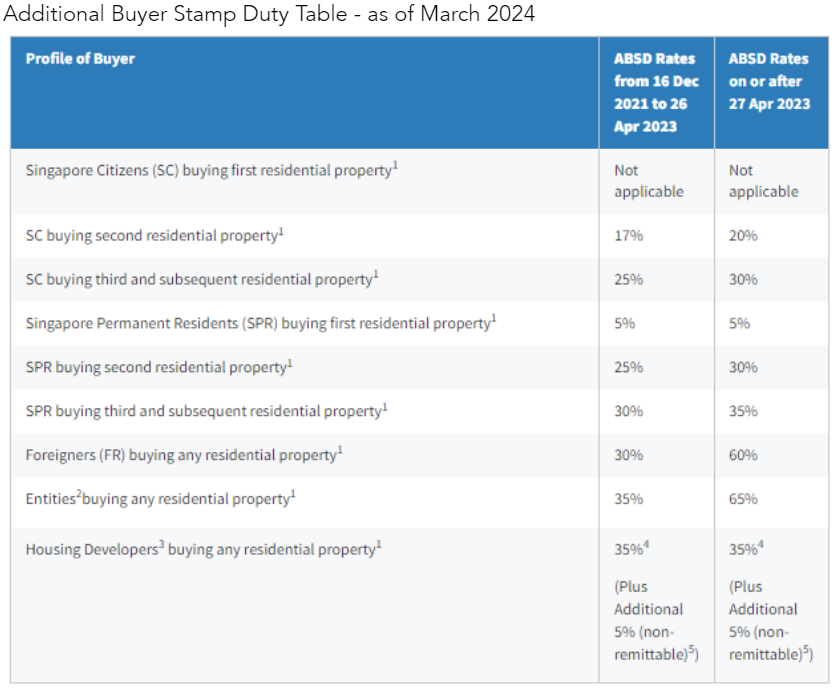

How much ABSD is payable depends on the profile (Singaporean / Singapore Permanent Resident / Foreigner) of the buyer, and also the property count.

- No ABSD is payable for Singaporeans buying their first residential property.

- 5% ABSD is payable for Singapore Permanent Residents buying their first residential property.

- 60% ABSD is payable for Foreigners buying any residential property

Note:

BSD & ABSD is based on the purchase price or valuation of the property, whichever is higher.

Using CPF for your property purchase

The amount of CPF that you are allowed to use for your property depends on a few factors, such as your age, the age of your property, and the number of properties you own that have utilised CPF. This section will focus on the CPF usage available for your first property purchase.

Question: Does the remaining lease of your property purchase covers the youngest owner who is using OA savings to at least 95 years old?

If your answer is “Yes”, and you do not require any loan for your HDB or Private Property purchase:

- You and your co-owners (if any) may use your respective OA savings to pay for the purchase, up to the lower of the purchase price or valuation of the property at the time of purchase.

- No further CPF usage is allowed thereafter.

If your answer is “Yes”, and you are taking a HDB Loan for the purchase of a Build-to Order (BTO) / Sale of Balance (SBF) / Re-offer of balance (ROF) flat:

- You and your co-owners (if any) may use your respective OA savings to pay your HDB loan.

If your answer is “Yes”, and you are taking a HDB Loan for the purchase of a Resale or Design, Build and Sell Scheme (DBSS) flat:

- You and your co-owners (if any) may use your respective OA savings to pay for the purchase, up to the lower of the purchase price or valuation of the property at the time of purchase.

- If you still have an outstanding HDB Loan after reaching this limit, you can continue to use your OA savings to pay for it, provided that you are able to set aside the Basic Retirement Sum (BRS).

If your answer is “Yes”, and you are taking a Bank Loan for the purchase of a HDB or Private Property:

- You and your co-owners (if any) may use your respective OA savings to pay for the purchase, up to the lower of the purchase price or valuation of the property at the time of purchase.

- If you still have an outstanding Bank Loan after reaching this limit, you can continue to use your OA savings to pay for it, provided that you are able to set aside the Basic Retirement Sum (BRS). The amount of additional OA savings you can use is capped at 20% of the lower of the purchase price or valuation of the property at the time of purchase.

- No further CPF usage is allowed thereafter.

If your answer is “No”:

- You and your co-owners (if any) may use your respective OA savings to pay for the purchase, up to a percentage of the lower of the purchase price or valuation of the property at the time of purchase.

- The exact amount will be determined on a case by case basis.

- No further CPF usage is allowed thereafter.

Buying a property need not be complicated, reach out to us today for a non-obligatory discussion.

Disclaimer:

The information provided in this blog is for general informational purposes only and does not constitute financial advice. While The Loan Connection (TLC) strives to ensure accuracy, we make no guarantees as to the completeness, reliability, or timeliness of the information. Readers are encouraged to verify details independently and consult qualified professionals before making any financial decisions. TLC is not liable for any losses or damages arising from reliance on the content herein.