Navigating the SORA Downtrend: A Homeowner's Guide to Refinancing in Singapore

In Singapore, one of the important factors shaping your mortgage payments is the Singapore Overnight Rate Average, or SORA. This benchmark which underpins many floating-rate home loans across the island, has been on a downtrend since early 2025, reaching levels not seen since late 2022. This is a development that could open up tangible opportunities for refinancing. Let’s dive into what this SORA dip means for your finances and explore whether now is the opportune moment to revisit your home loan options.

Table of Contents

ToggleWhat is SORA and why should you care?

SORA, or the Singapore Overnight Rate Average, is Singapore’s key benchmark for floating-rate home loans. It reflects the average rate at which banks in Singapore lend to one another on an overnight basis. What makes SORA a reliable and transparent standard is that it’s based on actual completed transactions in the unsecured overnight interbank SGD cash market—unlike its predecessors, SIBOR and SOR, which were based more on quoted or estimated rates. No bank has direct control over SORA, which makes it a transparent option for borrowers opting for a floating rate based on market conditions.

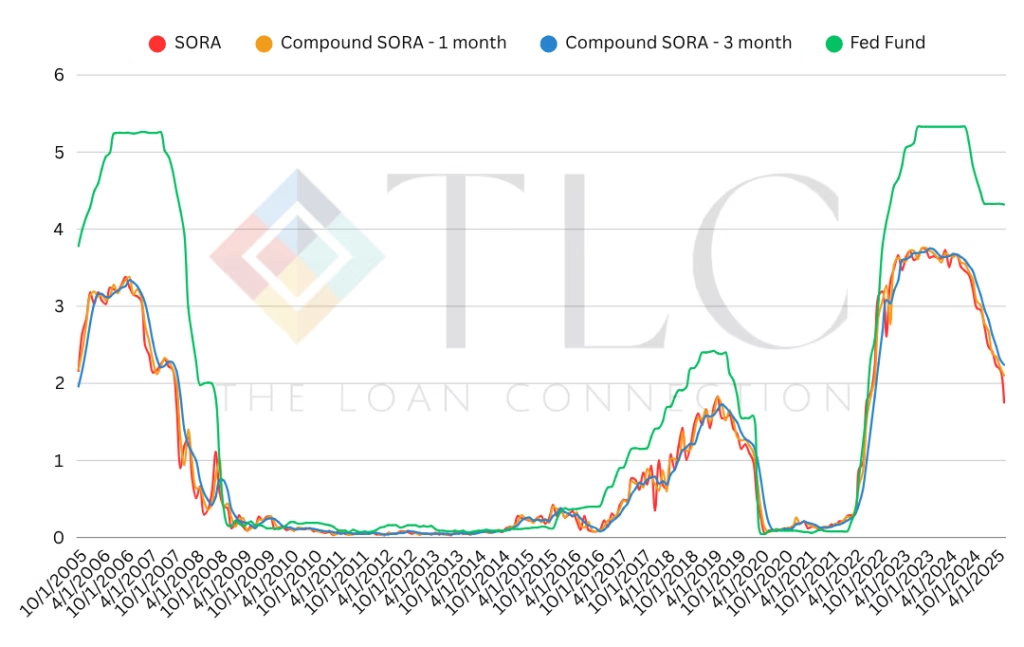

This transaction-based methodology reduces the risk of manipulation and strengthens its credibility. Since the official transition in 2022, SORA has become the dominant reference rate for retail loans. After peaking at around 3.6% in late 2023, SORA has been on a gradual decline throughout 2024, drawing renewed interest from homeowners reviewing their mortgage options.

Why are interest rates dropping in Singapore?

So, what exactly is driving this welcome downward trend in SORA, and why does it matter so much to your mortgage? The decline in SORA directly translates to lower borrowing costs for floating-rate loans, making it a significant factor for homeowners. This shift isn’t due to a single cause but rather a confluence of economic factors, primarily characterized by an abundance of liquidity within the banking system and a more subdued demand for loans. Let’s delve into these key drivers:

More Cash in the System

Imagine banks as financial reservoirs. Currently, Singaporean banks find themselves with a healthy surplus of cash. They are holding more deposits than they are lending out, a scenario reflected in a lower loan-to-deposit ratio. When banks have this excess liquidity, their need to borrow from other banks for overnight operations—the very transactions SORA measures—naturally diminishes. This reduced demand for overnight funds directly pushes the SORA rate downwards, a classic illustration of supply and demand at play in the financial markets.

Reduced Borrowing Appetite

Another significant contributor to the SORA dip is a noticeable cooling in loan demand from both individual consumers and businesses. In times of economic uncertainty, there’s often a more cautious approach to taking on new debt. This decreased appetite for loans means banks don’t need to aggressively seek overnight funds to finance new lending activities. With fewer borrowers, the competitive pressure among banks to secure funds from each other lessens, further contributing to the downward movement of SORA.

A Strong Singapore Dollar

The resilience of the Singapore dollar in 2025 has also played a crucial role. Amidst global economic fluctuations, the SGD has demonstrated remarkable strength, often outperforming many other Asian currencies. This robust performance makes Singapore an attractive destination for foreign capital, drawing in more funds into local fixed deposits. This influx of foreign money further enhances the overall liquidity in the system, making it even easier for banks to access funds and, consequently, easing borrowing costs.

Monetary Policy Adjustments

Adding to these dynamics is the Monetary Authority of Singapore’s (MAS) shift in January 2025 toward a more accommodative policy stance. While MAS manages the economy through exchange rate settings rather than interest rates, its move to ease the SGD’s appreciation path encouraged liquidity and confidence in the financial system. This helped reinforce the SORA downtrend, contributing to more affordable borrowing for homeowners with floating-rate loans.

How the U.S. Fed Funds Rate Influences SORA

While SORA is a domestic interest rate benchmark based on local interbank lending in SGD, it doesn’t operate in isolation. One of the biggest external influences is the U.S. Federal Reserve’s monetary policy, specifically changes to the Fed Funds Rate, which is reviewed during the Fed’s FOMC meetings.

Here’s why:

Global Capital Flows and USD-SGD Dynamics

When the Fed raises rates, U.S. dollar-denominated assets become more attractive. This can trigger capital outflows from emerging markets — including Singapore — as investors chase higher yields in the U.S. To manage the resulting pressure on the SGD, the Monetary Authority of Singapore (MAS) may allow or engineer SGD appreciation through its exchange rate policy, which can lead to tighter domestic financial conditions and upward pressure on SORA.

Bank Funding Costs

Singapore’s financial system is highly globalized. Changes in U.S. interest rates affect global funding costs and investor sentiment. If it becomes more expensive to raise USD funding, it often spills over into SGD markets, influencing the cost at which local banks lend to each other — the very foundation of SORA.

Market Sentiment and Forward Guidance

Although SORA is calculated based on past overnight transactions, those transactions are influenced by what banks expect to happen. If the market broadly anticipates that the U.S. Federal Reserve will cut interest rates soon, banks in Singapore may adjust their overnight lending behavior accordingly. This shift in activity — driven by future expectations — indirectly causes SORA to trend lower even though it’s technically a backward-looking rate.

Should you refinance your home loan right now?

With SORA on a downward trajectory, many homeowners are asking a crucial question: Is now the right time to refinance my home loan?

First, check if you're still locked in

Before considering refinancing, it’s essential to review your current loan’s lock-in period. Most home loans in Singapore come with a lock-in period of 2 to 3 years, during which early repayment or refinancing may trigger significant penalties.

If you’re still within this period, the cost of breaking the lock-in could outweigh any potential savings from refinancing. However, if your lock-in is expiring soon—typically within the next 3 months—it’s a good time to start reviewing your options. This is because your existing bank may shift you to a higher floating rate once the lock-in ends. Note that most banks require a minimum 2-month notice for refinancing, so early planning can help you avoid unnecessary interest costs.

Fixed or Float?

Let’s break it down with some numbers.

If you opt for a 2-year fixed rate at 2.15%, your total interest over the two years is locked in at 4.30%. This option suits borrowers who prefer stability and predictability in their monthly instalments. For instance, landlords receiving a fixed rental income often prefer this approach, as it provides better control over their cash inflows and outflows.

Now, let’s consider a floating rate package structured as follows:

- Year 1: 1M SORA + 0.25%

- Year 2: 1M SORA + 0.30%

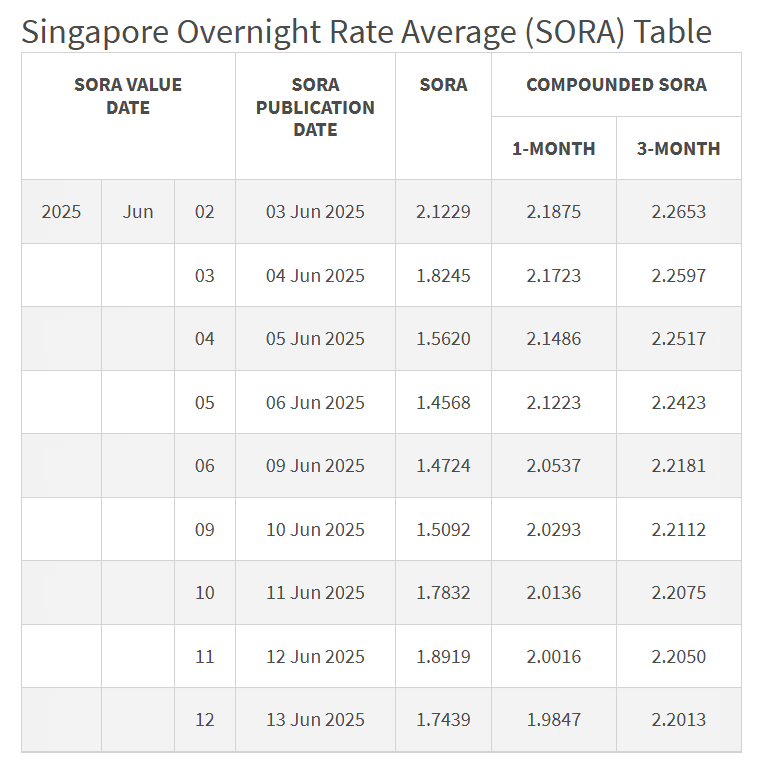

The SORA rates table shown above is taken from the official website of the Monetary Authority of Singapore (MAS). The original and most up-to-date data can be accessed at eservices.mas.gov.sg. This image is used here for educational and informational purposes.

Here, 1M SORA refers to the average of the past 30 days of the Singapore Overnight Rate Average. Similarly, 3M SORA is the 90-day average. Since SORA has been on a declining trend, both 1M and 3M SORA have been falling — with 1M SORA typically reacting faster to market changes.

Comparison:

A fixed rate totals 4.30% over 2 years.

To match this, the floating rate package needs 1M SORA to average 1.875% over the same 2-year period.

That’s because:

- Year 1: 1.875% + 0.25% = 2.125%

- Year 2: 1.875% + 0.30% = 2.175%

- Total: 2.125% + 2.175% = 4.30%

Given current SORA levels, this breakeven point is statistically achievable — and floating rates could potentially outperform fixed rates.

There’s no right or wrong choice. It ultimately depends on your risk appetite and your outlook on future interest rates. If you value certainty, fixed may suit you better. If you believe rates will continue to fall, floating could offer more savings.

Other factors to consider

- Fees: Always factor in the legal, valuation, and other administrative fees involved in refinancing. Additionally, watch out for potential subsidy clawbacks from your current bank if you refinance before a specified period.

- Subsidies: Check if the new bank is offering cash subsidies or reimbursements to help offset refinancing costs. These can significantly reduce your out-of-pocket expenses.

- Loan Tenure Flexibility: Can the new loan tenure be adjusted to better fit your financial plans?

- Extending the tenure lowers your monthly instalments, which can ease short-term cash flow.

- Shortening the tenure helps reduce total interest paid over time, which may suit borrowers with stronger cash positions.

- Loan Features: Look into the flexibility and features of the new package.

- Is there partial prepayment allowed without penalty?

- Can you sell the property during the lock-in period without incurring fees?

These features can offer added peace of mind and adaptability to life changes.

Navigating the Volatility

While the current SORA downtrend is certainly welcome, it’s crucial to remember that SORA is a floating rate. This means it can also rise again in the future, potentially pushing up your borrowing costs. Therefore, it’s always wise to ‘stress-test’ your budget. This involves calculating if you can comfortably manage your mortgage payments even if interest rates rebound. Being prepared for potential rate fluctuations is a cornerstone of sound financial planning.

Your Next Steps: Making an Informed Decision

The SORA downtrend presents a compelling opportunity, but making the most of it requires a proactive and informed approach. Here are some actionable steps you can take:

- Review Your Current Loan Details: Gather all the necessary information about your existing mortgage, including your current interest rate, remaining loan tenure, and most importantly, your lock-in period and any associated penalties for early termination.

- Compare and Contrast New Loan Packages: Compare SORA-pegged loan packages from various banks. Pay close attention to the interest rates, fees, and any other terms and conditions. Consider how these new packages align with your long-term financial goals.

- Seek Professional Advice: Navigating the complexities of home loans and refinancing can be daunting. Consider consulting with a qualified mortgage advisor. They can provide personalized guidance, help you understand the fine print, and ensure you make a decision that’s best suited for your individual circumstances.

Conclusion:

The recent downtrend in SORA rates marks a significant moment for Singaporean homeowners. It offers a timely and tangible opportunity to optimize your mortgage through strategic refinancing, potentially leading to substantial long-term savings. However, seizing this opportunity effectively hinges on making informed decisions.

Understanding the underlying causes of SORA’s movement, its direct impact on your finances, and proactively exploring your refinancing options are paramount to navigating this evolving market successfully. By staying informed, being proactive in reviewing your financial options, and seeking mortgage broker advice when needed, you can empower yourself to make strategic choices that align with your financial aspirations and secure a more favorable financial future for your home.

Disclaimer:

The information provided in this blog is for general informational purposes only and does not constitute financial advice. While The Loan Connection (TLC) strives to ensure accuracy, we make no guarantees as to the completeness, reliability, or timeliness of the information. Readers are encouraged to verify details independently and consult qualified professionals before making any financial decisions. TLC is not liable for any losses or damages arising from reliance on the content herein.