Your handbook to understanding mortgage better - 2024

Navigating the mortgage landscape in Singapore can be complex, especially with the ever-changing economic conditions and interest rates. As we move into 2024, it’s essential to understand the current financial climate and how it affects your mortgage options. With the Federal Reserve’s recent stance on interest rates, there are implications for borrowers in Singapore that should be considered when planning for a successful mortgage experience.

Table of Contents

Impact of global interest rates

In 2024, the Federal Reserve has taken a cautious approach towards interest rates, with some policymakers suggesting three rate cuts as a reasonable starting point, while others advocate for a more careful and gradual approach to adjusting policy restraint. This global financial environment impacts Singapore’s mortgage rates, as banks may adjust their rates in response to these international trends.

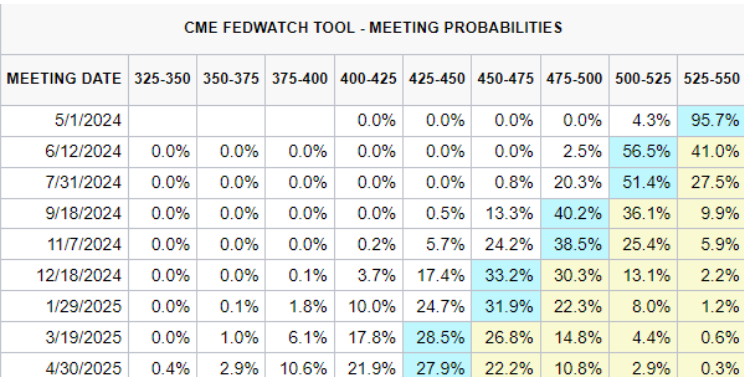

The table below from CME Fedwatch Tool shows the upcoming FOMC meeting dates and the rough probabilities that come along with it. We are expecting to see three rate cuts from the Fed this year, starting from June 2024.

Thoughts on Floating Rates in Singapore

Let us first start by understanding that no matter what type of floating rate package you choose from a bank, there will always be a:

“Variable Component (Reference rate that is determined by the bank / market conditions)” + “Fixed Component (Spread that is determined by the bank)” = Total Effective All-In Rate

There are generally three types of floating rates being offered by the banks today:

- Mortgage Board Rate (MBR): The MBR is a reference rate set internally by the bank and can fluctuate based on the bank’s discretion. It is not directly influenced by market conditions, and the bank is not required to disclose the factors that determine changes in the MBR. This lack of transparency can make MBR-pegged home loans less popular among borrowers. In certain niche situations, going for a MBR package can still be beneficial, especially if it does not come with any lock-in period.

- Fixed-Deposit Linked Rate (FD): The FD is a reference rate also set internally by the bank, and is pegged to the bank’s fixed deposit rates. While FD rates are known to be generally more stable, take note that they are still subject to change at the bank’s discretion.

- Singapore Overnight Rate Average (SORA): SORA is a backward-looking reference rate that reflects actual transactions between banks, making it the most transparent floating rate available in the market today. No bank has control over it, and it is updated daily on the MAS website here. The banks mostly either use 1MSORA (your variable component changes once every month) or 3MSORA (your variable component changes once every 3 months).

Example:

You bought a property and decided to go for the following floating rate package:

ABC Bank

1 Year Lock In

Year 1: 3MSORA + 0.50%

Year 2: 3MSORA + 0.50%

Year 3: 3MSORA + 0.50%

Thereafter: 3MSORA + 1.00%

Hence, “3MSORA” is the variable component while “0.50%” spread is the fixed component.

A simple illustration using the table below from MAS.

For example let us assume that 3MSORA is currently at 3.68% when the loan was disbursed.

What this means is that for the first 3 months, your total effective rate will be:

3.68% (3MSORA) + 0.50% (fixed spread) = 4.18% effective rate

(Take note different banks may have different SOP regarding which SORA value date to use)

This process will repeat every 3 months, since the variable component is a 3MSORA.

If you do not change to a new package after the 1 year lock-in is over, your fixed spread of 0.50% will still be guaranteed for the 2nd and 3rd year. What you do not have control over is the movement of the variable 3MSORA.

In general, SORA and the Fed Fund Rate have a positive correlation, when the Fed starts to reduce their interest rates, we can also expect to see SORA going on a downtrend.

When considering whether to go for a floating rate, it is important to have a good calculated estimate on the possible average effective all-in rate that you will be committing to. On top of that, the features that come with the package are important as well, it would be prudent to ensure that there is some flexibility to make partial repayments during lock-in for some risk mitigation.

Thoughts on Fixed Rates in Singapore

Fixed rates are generally considered the “safer” option because many people prefer stability and want to avoid surprises. It’s similar to booking a taxi at a fixed price to take you to your destination. Regardless of the route or any traffic jams you encounter along the way, you take comfort in knowing that the price is determined upfront.

However fixed rates do also come with their own set of risks, especially in our market environment today. We have just passed the peak of the interest rates, and with rates expecting to go down, what happens if you secure a 2 year fixed rate now, only to find out that 6 months later the rates being offered then are lower?

The decision to wait for a lower interest rate involves considering the opportunity cost. If waiting means paying a high 4% interest rate for a few more months to potentially save an additional 0.10% in the future, it’s important to calculate whether the savings from the lower rate would outweigh the costs of the higher rate during the waiting period.

Where to draw the line depends on your financial goals, risk tolerance, and the market outlook. If you believe that rates will significantly decrease in the near future, it might be worth waiting. However, if the expected decrease is minimal or uncertain, locking in a slightly higher rate now could be more prudent than risking an extended period at an even higher rate. The earlier your new lock in starts, the earlier it ends as well.

So, Floating or Fixed?

Both fixed and floating rate options come with their own different set of risks. Making an informed decision involves understanding the pros and cons of all options and recognizing your own risk tolerance. It’s important to have a clarity of your financial situation and the market trends to make a choice that you’re comfortable with.

As a mortgage broker, our role is to provide you with the knowledge and insights which will assist you in making a decision that aligns with your financial goals.

Understanding the monthly instalment of your loan package

Whether you chose a Floating or Fixed rate package, what affects the monthly instalment voices down to three factors:

- Interest Rate

- Loan Amount

- Loan Tenure

Naturally, a higher interest rate or loan amount will result in higher monthly instalment. In this case, have you ever wondered why sometimes the monthly instalment increases when you refinance or reprice to a lower interest rate package at a smaller loan quantum?

The reason is likely due to a shorter loan tenure, which results in higher monthly instalments as you will be paying off your principal in a shorter period of time.

Understand that a longer tenure will result in a lower monthly instalment, but higher interest payable, while a shorter tenure will result in a higher monthly instalment, but lower interest payable.

Example:

Loan Amount – $1,000,000

Interest Rate – 2 Year Fixed at 2.90%

- Tenure: 30 Years

- Monthly Instalment: $4,162.30

- Interest paid over 2 years: $56,814.76

- Tenure: 20 Years:

- Monthly Instalment: $5,496.05

- Interest paid over 2 years: $55,909.18

Hence, even though the loan amount and interest rates are the same, a shorter tenure of 20 years will increase the monthly instalment by $1,333.75 and decrease the total interest paid to the bank over 2 years by $905.58.

It is also good to be aware of the regulations surrounding your loan tenure options.

Getting your first home loan for your new purchase:

- If you require a loan amount higher than 55% LTV (Example you need a $550,001 loan for a $1,000,000 purchase): The loan tenure is capped at 30 years for private property and 25 years for hdb, loan tenure also cannot exceed age 65 for both.

- If you require a loan amount that does not exceed 55% LTV (Example you need a $550,000 or less loan for a $1,000,000 purchase): The loan tenure is capped at 35 years for private property and 30 years for hdb, loan tenure also cannot exceed age 75 for both. Take note minimum cash down payment will increase to 10% if tenure exceeds age 65 .

Refinancing your home loan, the banks will offer you the shorter tenure of the following 2 formulas:

- 75 minus the Income Weighted Average Age of all borrowers

- 35 minus the number of years since purchase, minus an additional 1 or 2 years depending on bank

Case Study:

- Client: Age 50, Single Owner and Borrower

- Took a 75% loan with a 15 year loan tenure, the mortgage package comes with a 2 years lock in

At the end of 2 years, he would like to do a refinancing and extend his tenure at the same time to reduce his monthly instalments due to the high interest rates.

His max tenure will be:

- 75 – age 52 = 23 years

- 35 – 2 (two years since he has purchased) – 2 = 31 years

Hence he has the option to extend tenure till 23 years, take note that he can always choose to shorten the tenure again in the future.

Monthly instalments for home loans can be paid using cash/cpf, while monthly instalments for equity loans can only be paid using cash.

Understanding the features of your loan package

Asides from the interest rates and lock in periods offered by the banks, here are some common features that the banks are currently offering to help value add.

- Free conversion: The most common feature offered by banks, it waives off the administrative fee from the bank when you apply to change packages internally. Without this, the fee will usually start from $300.

- Partial repayment flexibility: Certain packages allow you to make partial repayment up to a certain percentage during lock-in period. Without this, the bank will levy a 1.5% penalty fee on the amount of partial repayment made.

- Full waiver of penalty fee due to sale: This allows you to sell your property anytime. Without this, the bank will levy a penalty fee of 1.5% on the outstanding loan amount if you sell the property during the lock-in period.

- Partial waiver and refund of penalty fee due to sale: This features waives off half of the 1.5% penalty if you sell your property during the lock-in period, and will refund you the other half if you take up a new home loan with the same bank within six months, new loan amount must be the same or greater that the outstanding loan amount.

- Full waiver of cancellation fee due to sale: For uncompleted new launch condos, they follow a progressive payment schedule where the loan is disbursed in batches till the property achieves Certificate of Statutory Completion (CSC) status. Most mortgage packages do not come with any lock in period, hence there is no penalty fee charged on the disbursed loan amount if you sell. However, the bank will still charge you a cancellation fee of 1.5% of any undisbursed loan amount. This feature waives off the cancellation fee of any undisbursed loan amount in the event of sale.

- Mortgage Interest Offset Accounts: Mainly reserved for floating rate packages, this allows the client an option to open a special account with the bank, deposits in this account will earn the same interest as the mortgage interest rate. Terms and Conditions apply.

Understanding the cost involved of your loan package

When it comes to buying a new property or refinancing your home loan, the two costs involved are legal fees (payable to law firms by cash or cpf) and valuation fees (payable to HDB/banks by cash).

Based on March 2024:

HDB Purchase:

- Legal Fee for BTO: $2,000 estimate

- Legal Fee for HDB resale: $1,800 estimate

- Valuation Fee for HDB resale: $120

Private Property Purchase:

- Legal Fee: $2,500 will be the market range, if it is big purchase – fees could be higher

- Valuation Fee: Starting from $350 onwards depending on valuation of property

HDB Refinance:

- Legal Fee for HDB resale: $1,500 estimate

- Valuation Fee for HDB resale: $200 estimate

Private Property Refinance:

- Legal Fee for HDB resale: $1,800 estimate

- Valuation Fee for HDB resale: Starting from $350 onwards depending on valuation of property

Depending on a few factors, banks may provide a subsidy to help defray the cost involved.

Ending notes

For most people, a mortgage loan is one of the biggest financial commitments. If managed well, it could save you tens of thousands over the years. In such an expensive city like Singapore, making prudent financial decisions involving your mortgage will definitely help to ease the financial burden on your family. Staying well-informed and having a good financial knowledge are keys to managing your mortgage well.

Alternatively, reach out to a mortgage broker whom you trust and whose service you find exemplary.

Disclaimer:

The information provided in this blog is for general informational purposes only and does not constitute financial advice. While The Loan Connection (TLC) strives to ensure accuracy, we make no guarantees as to the completeness, reliability, or timeliness of the information. Readers are encouraged to verify details independently and consult qualified professionals before making any financial decisions. TLC is not liable for any losses or damages arising from reliance on the content herein.